What is Captive Health Insurance?

A health insurance captive is a wholly owned subsidiary insurer that provides risk-mitigation services for its parent company or a group of related companies. The employer, along with other similar-sized enterprises, sign up to become participants of the plan. As member-owners of the program, the participants all agree to spread the risk, using a stop-loss insurance model. This approach is designed to reduce volatility.

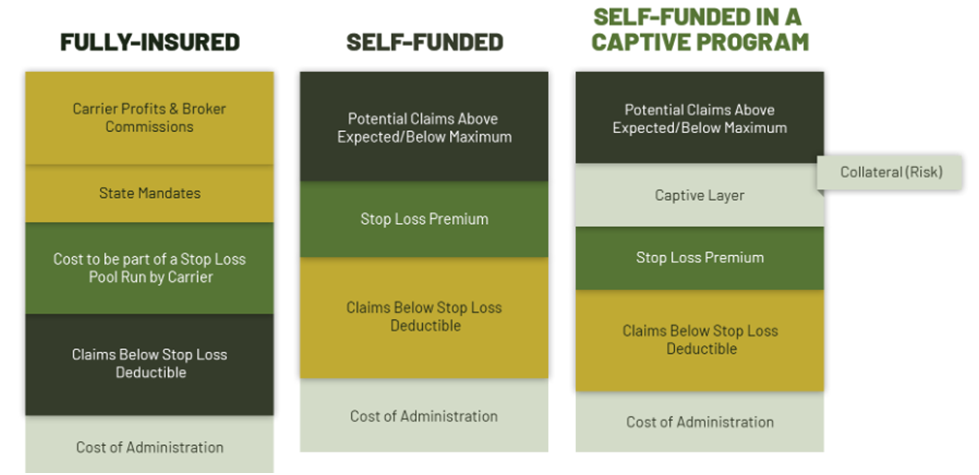

Captive Plan Vs. Self-Funded Plan

A health insurance captive is a self-funded plan. The component of a captive that is unique is that the stop-loss will have an additional layer of coverage where some premiums are directed. This extra layer of stop-loss is usually a owned subsidiary insurer that provides risk-mitigation services for its parent company or a group of related companies. The employer, along with other similar-sized enterprises, sign up to become participants of the plan. As member-owners of the program, the participants all agree to spread the risk, using a stop-loss insurance model. This approach is designed to reduce volatility.

Understanding the captive layer

- Of your total specific stop loss premium, a high percentage flows through the captive layer this amount is your potential dividend

- Any claims over your specific deductible amount reduce your potential dividend

- Large losses are no longer part of the captive layer once they hit your specific deductible amount (plus the maximum amount for your self-funded retained layer)

- When you use all your potential dividend, you start using the rest of the group’s potential dividend as part of the captive layer shared risk

- When all potential dividend is gone, collateral is reduced until depleted

- When all collateral is gone, the captive has an aggregate policy that takes over

Who is a good fit for a captive health plan?

- A captive health plan can be a good fit for employers that have demonstrated consistent profitability on the stop-loss portion of a self-funded health insurance plan.

- If your group is willing to pay additional premiums to have more stable cashflow and protection from large claims.

- If your group is consistently having difficulty obtaining stop-loss insurance for their self-funded plan.

- Your group of employees are non-traditional, (part-time / seasonal), and therefore it is difficult to obtain a qualified medical plan.

- Your captive pricing is below the pricing of the stop-loss market.

Who is not a good fit for a captive health plan

- A captive health plan is not a good fit for employers which that have not demonstrated consistent profitability on the stop-loss portion of a self-funded health insurance plan.

- If your group is able to obtain low cost stop-loss insurance for their self-funded plan.

- Your group of employees are in a traditional industry.

- Your captive pricing is above the pricing of the stop-loss market.

With a captive insurance program, you should also consider the following complexities of the captive layer:

- Assume increased risk – When you form a captive program, you are your own support system. There’s nobody else paying into the pool of funds that’s used to bail you out in a pure captive, and even in a group captive, if multiple partners have bad years, it can lead to major financial complications. If your business is risk-averse by nature, a captive might not be right for you.

- Take on up-front expense – Establishing a captive is a time-consuming process that requires creating an insurance company from scratch. That means, as you’re planning and building your program, you’ll need to take on more hires, acquire new licenses, and bring in some consultants who are captive experts. At the same time, you need to allocate capital to underwrite your plans.

- Create new management responsibilities – People sometimes misunderstand that a captive can be managed by a human resources department’s employee benefit expert. That’s actually not true, as the captive is a full-time, constantly operational insurance company. That means either bringing in new managers to operate the division or creating new responsibilities for other members of your core team.

- Risk taking a step back –It’s possible that, in its initial years, your captive might not do as good of a job as a traditional provider. If you’re not comfortable taking one step back to take two steps forward, a captive probably doesn’t fit your leadership style.

Summary

A captive insurance plan may not be for everyone. But, if you examine the pros and cons and determine the advantages outweigh the disadvantages, you should act right away. Any delay in your switch could cost your employees and your business as a whole.