Partially Self-Funded Health Plans

More than 57 percent of employers now use some type of self-funding in their benefit plan. Self-funding has been around for more than 30 years and it allows employers to be exempt from state insurance laws, including reserve requirements, mandated benefits, premium taxes and consumer protection regulations. It maximizes cash flow by paying claims as they are rendered, rather than pre-paying or issuing premiums.

By self-funding, employers eliminate carrier profit margins and risk charges, saving 3-8 percent annually. Employers can also take advantage of wellness programs and other cost containment features to drive costs down. Plus, with the passing of healthcare reform (PPACA), interest in self-funding has grown, giving control back to the employer.

Partially Self-Funded Vs. Fully Insured Health Plans

Partially self-funded plans offer an alternative to traditional health insurance plans. It allows companies to budget for small predictable claims while protecting the group against unpredictable catastrophic claims, through the purchase of stop loss protection. A partially self-funded plan can be written for groups with as few as 25 participating employees, and usually becomes a practical option for groups with more than 100 participating employees.

Cost Comparison – Fully Insured vs. Partially Self-Funded

A fully insured or traditional product is a fixed cost and no matter how many claims you incur, or don’t incur, you pay the same monthly cost. With a partially self-funded product you pay the claims as they are incurred. In the years with “average” to “below average” claims, you reap the savings. In the “bad” years your plan can cost a considerable amount more than a fully-insured plan.

Advantages of a Partially Self-Funded Plan

-Potential savings: Self-funded plans can save employers an average of 8-10% per year compared to fully insured plans. This long-term savings can help offset the annual 7-8% increase in healthcare costs.

-Tax advantages: Self-insured plans are not subject to state premium taxes, which can result in savings of 2-3% depending on the state.

-Elimination of carrier margins: By self-funding, employers avoid paying for insurance company profits, which can lead to savings of 3-8% depending on the company size.

-Cash flow benefits: Self-funded plans allow employers to retain cash reserves (typically 10-12%) instead of paying them to insurance companies, potentially earning interest on that money.

-Customization and flexibility: Self-funded plans offer greater control over benefit design, allowing employers to tailor coverage to their employees’ needs and potentially reduce costs.

-Transparency: Self-funding provides access to claims data, enabling employers to identify high-cost areas and implement targeted cost-reduction strategies.

-Variable costs: Approximately 75% of costs in self-funded plans are variable, compared to the fixed costs of fully insured plans, offering potential for substantial savings.

Advantages of a Fully-Insured Plan

-Ease of Administration.

With fully insured plans the administration is the responsibility of a single carrier. This reduces the need for separate claims, reinsurance, and pharmacy Third Party Administrator’s.

-Known Cost.

With fully insured plans the cost is fixed. This is fixed cost is appealing to many groups because many groups do not want to be exposed to fluctuating, and sometimes high claims.

-Fiduciary Responsibility.

The fully insured contract places the carrier in the role of the health plans fiduciary. This fiduciary responsibility lowers the legal exposure of the group.

Limit your Exposure With Stop Loss Protection

With a partially self-funded plan, you pay the claims as they are incurred. Stop loss protection is purchased to limit your financial exposure. Stop loss insurance protects you by paying when any one individual or the entire group exceeds a predetermined amount.

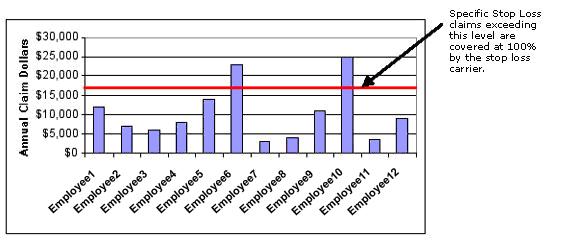

-Specific Stop Loss

Specific stop loss limits the claims exposure, per person, up to a level you choose. Claims exceeding this level are covered at 100% by the stop loss coverage.

-Aggregate Stop Loss

Aggregate stop loss limits the claims exposure for your entire group. If total claims paid by your group reach this level, the stop loss coverage assumes 100% of eligible expenses for the remainder of the plan year. This Aggregate stop loss limit is pre-determined by an underwriter and is based on your choice of Specific stop loss level and plan benefit design.

Reinsurance Contract Types

Choosing the correct contract type for your group is VERY important part of designing a health plan to meet your needs. You should always choose a contract that will protect your group from unexpected exposure with the proper Run-out coverage. You can rely upon MWA to help you in determining which contract will provide your plan the best protection at the most reasonable price.

Glossary of Self-Funded Terms

-Aggregate Stop-Loss:

Aggregate stop-loss insurance limits the overall annual claims liability by reimbursing

the company when the claims paid for the self-funded plan, as a whole, exceed a certain preset level.

-Attachment Point:

For aggregate stop-loss insurance it is the point at which the stop-loss insurance carrier reimburses the employer based upon the cumulative total of claims paid within a contract period.

-Contract Period:

The time covered under a contract designating when a claim is incurred and when the claim must be paid to qualify for reimbursement.

-Plan Year:

The 12-month period in which deductible and co-insurance accumulates toward a plan participant’s out of pocket maximums.

-Reinsurance:

Another term for stop-loss coverage.

-Run-In:

Claims incurred prior to a plan year but reported after the end date of the plan year. These claims can be paid under the “current year” contract that includes the run-in period and the current plan year claims.

-Run-Out:

Claims incurred during a plan year but reported after the end date of the plan year. These claims can be paid under the “prior year” contract.

-Specific Stop-Loss:

Individual or specific stop-loss insurance provides reimbursement in the event an individual plan participant has claims that exceed the specific deductible during a contract period.

-Specific Deductible:

The amount of claims for which the plan is responsible for on any one individual in a contract period.